Business Insurance in and around Atlanta

One of Atlanta’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Cost Effective Insurance For Your Business.

Operating your small business takes time, hard work, and terrific insurance. That's why State Farm offers coverage options like business continuity plans, extra liability coverage, errors and omissions liability, and more!

One of Atlanta’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Insurance Designed For Small Business

When you've put so much personal interest in a small business like yours, whether it's a juice store, a bakery, or a pet groomer, having the right insurance for you is important. As a business owner, as well, State Farm agent Will Mobley understands and is happy to offer customizable insurance options to fit what you need.

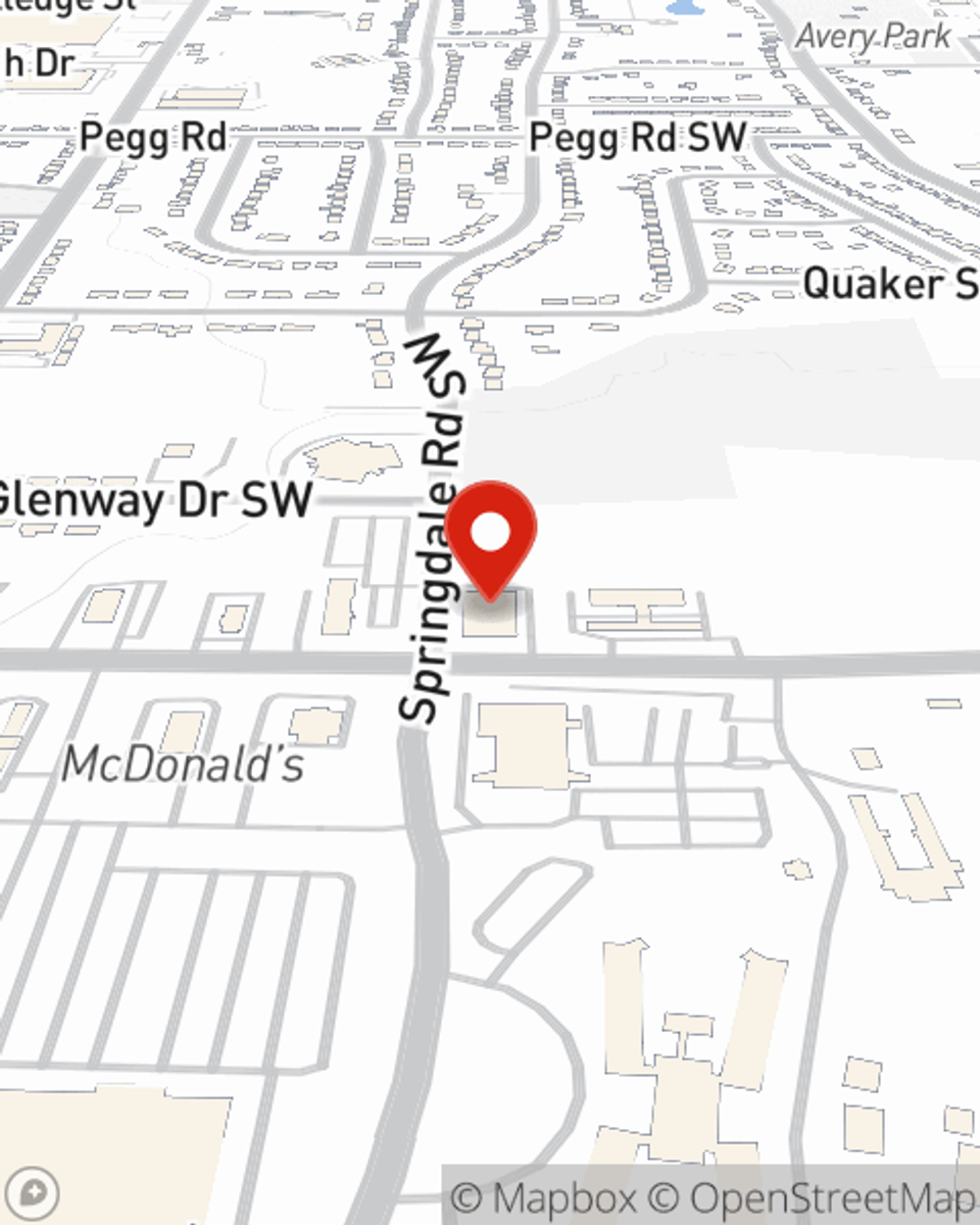

Ready to review the business insurance options that may be right for you? Visit agent Will Mobley's office to get started!

Simple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Will Mobley

State Farm® Insurance AgentSimple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.